Sikirapay Individual Account

1. You have received an invitation email. Filled in your personal information and paid the registration fee of €15.

2. Next, download our Sikirapay mobile application.

**Please note:** At this stage, you do not yet have an account with us. The €15 you paid covers the KYC (Know Your Customer) process cost, which will begin once you click on “SIGN UP.”

3. Click “SIGN UP” (see the image below) to continue your registration.

Sikirapay Individual accounts are currently available for private individuals within the EU and EEA.

Austria, Belgium, Bulgaria, Croatia, Cyprus, Czech Republic, Denmark, Estonia, Finland,

France, Germany, Greece, Hungary, Iceland, Ireland, Italy, Latvia, Liechtenstein, Lithuania,

Luxembourg, Malta, Monaco, Netherland, Norway, Poland, Portugal, Romania, Slovakia,

Slovenia, Spain, Sweden, Switzerland, UK – Great Britain.

We will add your application to our priority waiting list and will notify you as soon as our services become available in your country.

To verify your identity, please provide one of the following forms of identification:

- National ID card

- Passport

To confirm your address, you must submit one of the following documents, dated within the last 90 days, clearly displaying your name and address:

- Utility bill (e.g., electricity, telephone, or subscription bill)

- Bank statement

- Tax authority letter

- Lease or rental agreement

You can find the list of required documentation on our website:

Required documents for Individuals

To open a bank account anywhere in the world, you must fill out the account opening application. Your application must be registered in the bank system before it starts processing. While many banks typically charge a fee for this process, our team handles the registration at no cost to you.

However, we do need to pass on the fees invoiced by our partners for essential checks such as KYC (Know Your Customer), AML (Anti-Money Laundering), PEP (Politically Exposed Persons), and ATL. Therefore, we charge a one-time fee of €15 to cover these necessary services.

You are automatically enrolled in the FREE plan, which means there are no monthly fee charges. You only pay when you use your account or card.

For more details about our subscription plans and their benefits, please visit the Subscription Plans page, located under the FEES section on our website.

Sending a payment from your SikiraPay account is straightforward. This guide will walk you through the steps to initiate an outgoing bank transfer and explain the types of transfers you can make.

Steps to Send an Outgoing Bank Transfer

- Access Your Account:

- Log In: Begin by logging into your SikiraPay account

- Click: Send Money

- Select: Internal or External

- Select Recepient

- Enter the required data

- Cllick on Submit

There are two ways to open a bank account with us:

1. **Invitation from Our Affiliate Partners**

If you received an invitation email from our Affiliate Partners, simply open the email, click on “Register,” and follow the provided instructions.

2. **If You Have Not Been Invited by Our Partners**

Visit https://www.sikirapay.eu. Click on “Open an Individual Account” and follow the instructions.

Your account will be activated within 30 minutes if your documents are OK. Therefore, providing accurate documentation is essential.

I have been late with my payments in the past and have been marked as a bad payer. However, my financial situation has improved, and I would like to know if I can open an individual account with your company despite my current bad credit status.

Yes, we offer individual accounts to individuals with payment notes. Your past does not define you. As long as you keep up with your monthly fee payments, your account will remain active with us.

Your master account is opened in EUR and has a unique IBAN and BIC code specifically designated for SEPA payments.

**Payments Outside the SEPA Community:**

To make international payments outside the SEPA community, you will need a SWIFT account. We can assist you with this type of transaction. Please contact us at support@sikirapay.eu.

Yes. Any Personal or Business Client of Sikirapay is granted free access to our online banking services provided using the App and Web version.

Yes, You can easily access your Sikirapay account via your smartphone at www.sikirapay.eu or by downloading our mobile banking app (Sikirapay for iOS and Android). You can download the app here: “Coming soon”.

You have downloaded our app. Just log in to your using our app.

Mac user can log in by using both the app and desk top.

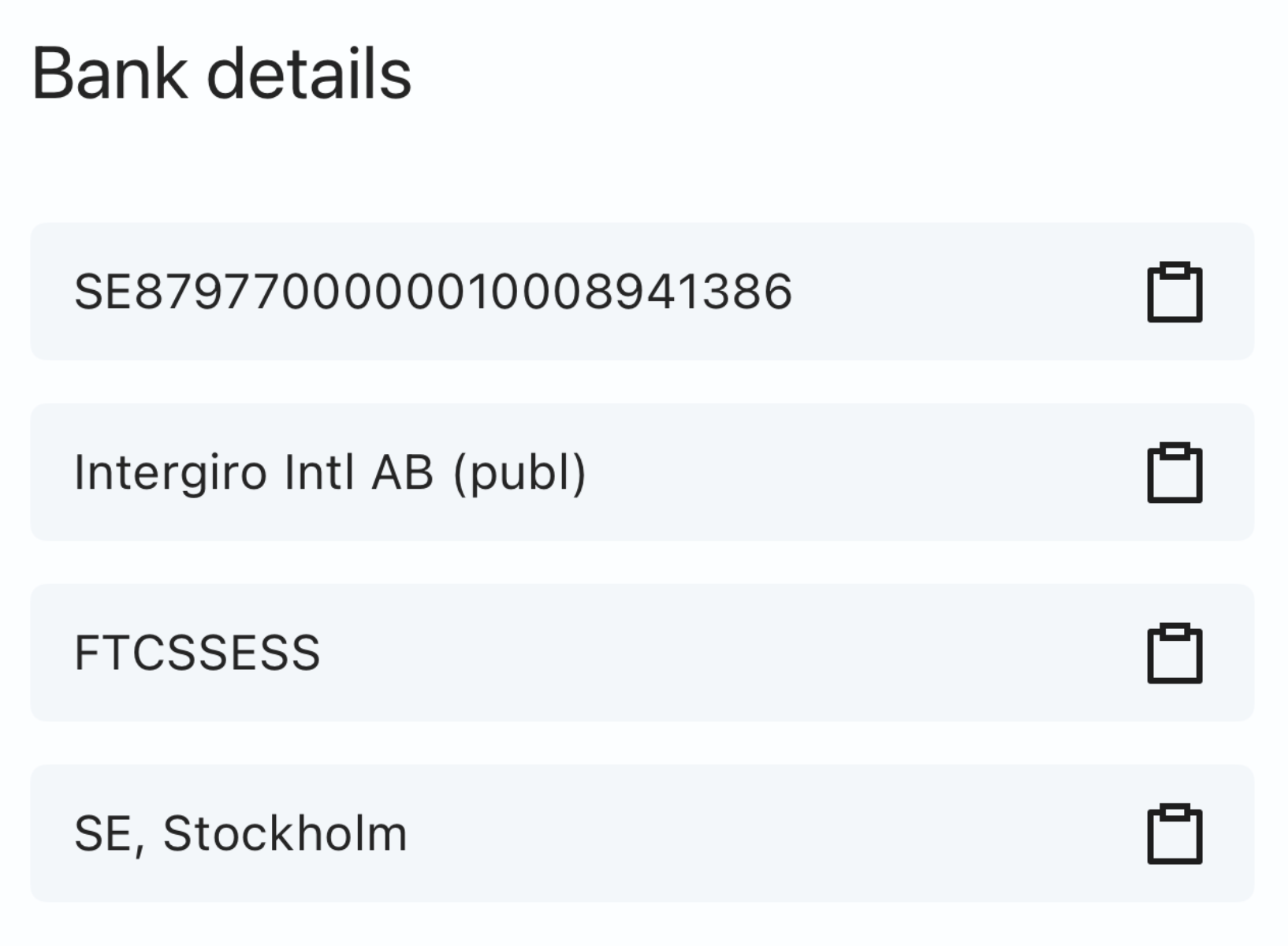

You can see your account details, including the IBAN by following the written steps:

→Log in to your account

Click on Profile

Click on Bank details

→ Your IBAN, bank name and BIC will be shown.. see the picture below

Your current account is in euros (EUR). We currently do not offer multiple currency accounts. We are actively working on this feature and will soon provide currency accounts for private individuals.

Please note that any payments made in EUR will be converted to the local currency using the exchange rates provided by the local bank.

It is not possible to reactivate a closed account. If you would like to use our services again, please send us an email to support@sikirapay.eu

How to Receive Funds in Your Sikirapay Account

To receive money, you’ll need to share your complete account details with the sender. Here’s how to easily find them in your Sikirapay Client Office:

- Log in to your account

- Click Profile at the right down corner

- Click Bank details

- You will see your IBAN, bank name, BIC

Send these detais to the person or company who will be sending money to you. The example below shows what your account information will look like.

How to Add Money Using Your Bank Card

- Log in to your account.

- Click “Add funds.”

- Enter or select the amount you wish to add.

- Click “Add funds.”

- Provide your card details.

- (Optional) Select “Save payment method” for faster future transactions.

- Click “Proceed.”

You will receive an instant notification once the funds are successfully added.

In order to change your personal details log in to your account. Go to Personal information.

A complaint can be submitted via three channels:

- Registered mail sent to our office address at Sikirapay 13, 11442 Stockholm, Sweden.

2. E-mail complaint@sikirapay.eu;

3. Online form https://sikirapay.eu/customer-complaint-form/.

We welcome any constructive critical feedback from our customers and kindly ask you to provide a detailed explanation of the issue/s you are experiencing. This will help us take appropriate action immediately.

In order to reset your password go to log in and click on “I forgot my password”. We will mail to you a link to reset your password.

In order to change your personal details log in to your account. Go to Personal information.

At Sikirapay, we strive for an improved user experience while maintaining high-security standards.

For that purpose, we have implemented two-factor authentication for your Sikirapay account. This adds another layer of security that protects your account from unauthorized access and your money at all times.

The security of your account is Sikirapay’s top priority. That’s why we have provided a two-step verification process that offers an additional layer of protection to keep your money and personal information safe.

How It Works

- The system will request you to enter your usual password.

- You will then open your Google Authenticator application installed on your phone to receive a one-time code (OTP)

- Once you receive the OTP, you will need to enter it and click “Sign in” to log into your account.

The payment execution process will also be slightly different:

Once you enable OTP two-factor authentication, you will no longer need a transaction verification code. By enabling OTP 2FA, you will be able to send payments using Google Authenticator one time code (OTP), which will be sent to your mobile device.

You have to be at least 18 years old.

Of course, you can pay your bills directly from your account, as long as the recipients have provided their IBAN, BIC, or SWIFT account number. It’s a convenient feature that saves you time and hassle, and helps you keep track of your expenses.

Your account is an international bank account (IBAN), which means you can receive not only your salary but also any money transfer to your account within EU and EEA. This is a convenient feature that allows you to easily manage your finances. Enjoy the benefits of having an IBAN account!

Receive money to your account

- From another account within SikiraPay = 0,12€

- From another bank account outside the SikiraPay = 0,12€

Send money from your account

- To another account within SikiraPay = 0,00€

- To another bank account outside the SikiraPay = 0,00€

To receive money to your account

It depends which subscription plan you use

Free plan: To receive money from another bank = 3,85

Plus plan: To receive money from another bank = 0,12

To send money to another bank is free of charge.

There is no limit on the amount that can be received in the account. However, all account transfers and card transactions will be subject to routine compliance checks. In certain situations, access to the account may be restricted during investigations.

Currently, you are allowed to have only one IBAN.

Using your IBAN you can make transfers to individuals and businesses bank accounts within Europe (SEPA countries).

All payments are processed as per our cut-off times, depending on the type of payment, destination and recipient bank.

For a payout in euro using the SEPA network, we receive your payment order immediately upon your submission of the payment order if you submitted it at the latest 14.30 CET on a banking day and we will execute it on the same banking day. If you submitted the payment order after 14.30 CET, we will receive it and will execute it on the following banking day. The recipient will generally receive the payout the next banking day, however it may take longer depending on the recipient’s bank.

To open an account yuu have:

- Download our app

- Follow step by step instructions

- Documents for your identification: ID or passport

- You can not use driver’s licence for your identification

- Proof of address in the EU or EEA: utility bill, bank statement, tax authority letter, rent bill, phone subscription not older then 3 months

Within the SEPA system, all transactions require the sender’s and beneficiary’s IBAN, or International Bank Account Number, which is a unique code that serves as an address from and to which the payment is sent. IBAN contains the bank identifier, the country code, and the account number in the bank itself, which makes it sufficient to execute most payments, especially Credit Transfers.

IBAN

An IBAN contains the bank chain number or code, a two-digit country code, a checksum to ensure its integrity, and the account number in the financial institution itself. A regular IBAN looks like this:

DE89 3704 0044 0532 0130 00

Here, DE — is the code for Germany, 89 is the control number, calculated using all other digits, 3704 0044 is the code of the bank, as well as of the bank office the account was opened at, and 0532 0130 00 is the account number. Such a precise coding system minimizes the possibility of errors and ensures that every transaction reaches its recipient.

It is worth mentioning, that in different countries IBANs may contain extra letters together with digits; however, the length and overall appearance is generally identical.

Business Identifier Code, or BIC, is a unique short code that serves for the identification of banks, their branches, credit unions, and other money institutions. For SEPA CT within the Eurozone, these are usually not needed, but sometimes a bank may require this information to issue Direct Debit payments.

BIC

A BIC contains four digits that stand for the bank code, a two-digit country code, and two to five digits (letters or numbers) that indicate the exact bank office. Here’s an example:

UAPLLT21XXX

Here, UAPL is the designated code for Sikirapay, LT is the country code of Lithuania, and 21XXX is the company’s designation for the central office in Vilnius.

SWIFT

SWIFT is another cross-border wire transfer network, which is accessible from pretty much anywhere. Currently, over 10,000 banking institutions in 210 states are connected to SWIFT. Its rules are practically identical to those of SEPA; however, SWIFT transactions are executed in pretty much any currency. Businesses located in Europe use SWIFT for their financial operations, but there are several key differences that make SEPA much more convenient for Euro payments.

SWIFT is not free. Any bank is allowed to set and charge commissions, for both incoming and outgoing transactions. Not all financial institutions are connected to SWIFT without third parties, but instead use correspondent banks that act on their behalf, following mutual agreements. Thus, one simple transaction may sometimes be subject to fees from a couple of different institutions!

Another difference is transaction speed. While SEPA instant credit transfers only need ten seconds to be executed, some SWIFT transactions may take up to a few working days.

SWIFT supports any currency, and this is both an advantage and a drawback. Let’s say, the recipient and sender operate in two different currencies. In this case, the funds will be converted automatically using exchange rates that are not beneficial to the parties, along with institutional commissions.

SWIFT is a fundamental worldwide payment instrument that is, however, slowly giving up to SEPA transfers, as more and more businesses outside of Europe are opening Euro current accounts to operate within the system.

It is worth mentioning that since these two methods are different, SWIFT transfer cannot be received on a SEPA account, and vice versa.

The SEPA countries include 27 EU member states: Austria, Belgium, Bulgaria, Croatia, Cyprus, The Czech Republic, Denmark, Estonia, Finland, France, Germany, Greece, Hungary, Ireland, Italy, Latvia, Lithuania, Luxembourg, Malta, The Nederlands, Poland, Portugal, Romania, Slovakia, Slovenia, Spain, Sweden

and the

United Kingdom, Iceland, Norway, Liechtenstein, Monaco, Switzerland.

PAY ATTENTION TO THE FOLLOWING:

PAYMENTS TO COUNTRIES THAT ARE NOT MEMBERS OF SEPA (Single Euro Payments Area) CANNOT BE CARRIED OUT via IBAN.

PAYMENTS TO THESE COUNTRIES CAN STILL BE MADE via SWIFT.

You must have a SWIFT account to send money (make transfers) from your account to a country outside the SEPA community. For now, we do not offer SWIFT accounts to individuals, but we can help you.

We offer a SWIFT service to our customers. If you need to make a transaction to a country outside the SEPA community, go to “Financial Products,” click on SWIFT, and follow the instructions.

To pay a bill, an invoice etc. costs 0,00€.

To send money from your account

- To an account within SikiraPay = 0,00€

- To an account with another bank outside of the SikiraPay =0,00€

Transferring money between Sikirapay accounts

Sender account pays = 0,00€

Receiver account pays = 0,12€

Your VISA card is a debit card directly connected to your account. So you do not have to transfer money to your card in order to use the card. Of course you have to have enough with funds on your account.

Your account is set in EUR.

Importance of Documentation

Ensuring the transparency and security of our customer interactions is a top priority. Required documents such as identification and proof of address play a crucial role in confirming our clients’ identities and maintaining the integrity of our financial services.

Reasons for Document Requirements

- Identity Verification: Proper identification helps verify that customers are who they claim to be, reducing the risk of fraud.

- Regulatory Compliance: As a financial institution, Intergiro is obligated to adhere to strict regulatory standards.These include Know Your Customer (KYC) and Anti-Money Laundering (AML) regulations, which mandate collecting and verifying customer information.

- Operational Security: By verifying the identities and addresses of our customers, we ensure that our operations remain secure and that we only transact with legitimate entities.

- Risk Management: These documents help assess and manage financial transaction risks, protecting the customers and the institution from potential financial crimes.

Document Types Required

- Identification Documents: Typically, this includes a government-issued passport or national ID card containing a photo to confirm the account holder’s identity.

- Proof of Address: Documents such as recent utility bills or bank statements that verify the customer’s current residential address.

Conclusion

The collection of these documents is not only a regulatory requirement but also a critical security measure. It ensures that all financial transactions are transparent and secure, protecting the interests of the customers and the institution.

Intergiro is an e-money institution, not a bank. We do not lend customers money, so we are not eligible to participate in deposit protection schemes. Instead, under the Electronic Money Regulations 2011 (FRN 900010), we are required to protect our clients’ money by safeguarding all deposits in an account held with another financial institution. That means that, in the unlikely event that we become insolvent, client money will be unaffected and will be refunded to clients in full.

As an electronic money institution providing online payment services, we (Intergiro) cannot lend your money to third parties.

Safeguarding practices protect your money. We are required by law to protect our clients’ money by safeguarding it with a partner bank segregated from Intergiro’s own funds. When you receive or transfer funds, we credit the equivalent e-money value into your account and simultaneously place the received funds into ring-fenced accounts (separate from our own money) held with established global banks.

Your money is safe with us. Intergiro is an Electronic Money Institution regulated in Sweden by Finansinspektionen (the Swedish Financial Supervisory Authority) under the Swedish Electronic Money Act (2011:755), License Reference: 48003, for issuing electronic money.

By law, we are required to protect clients’ funds by keeping them in a segregated bank account, separate from Intergiro’s own funds. This means your money is stored in a dedicated account that only you can access.

We do not use your funds for reinvestment or our own purposes.

In the unlikely event that Intergiro becomes insolvent, your funds will remain unaffected and will be fully refunded to you.

We are not a bank. To provide IBAN, VISA cards and payment services we have partnered with Intergiro AB Int.(pub), a Swedish fintech company licensed and registered as an Electronic Money Institution (EMI) with the Swedish Financial Supervisory Authority (Finansinspektionen).

We (Intergiro) are a place where you can store and use your electronic money. Electronic money is money in digital form, which can be used to make payments electronically or with payment methods such as a physical or virtual card. Since we are an electronic money institution, not a bank, we do not lend your money to others. Under the terms of our e-money license, we are not permitted to pay you interest, and deposit guarantee schemes do not cover the money in your account.

We (Intergiro) operate as a regulated e-money institution, distinct from a bank. Our e-money license, overseen by the Swedish Financial Authority, prohibits lending customers’ funds to other customers.

To ensure the security of our customers’ money, we employ ‘safeguarding’ practices. Deposits are stored separately from our own funds, following the E-Money Directive (2009), enabling swift fund return in the event of insolvency through a low-risk holding bank.

Opening an account with us takes minutes, avoiding the traditional bank’s lengthy processes. Our multi-currency wallets facilitate quick international payments, and instant notifications keep customers informed. Future features include virtual card management, receipt capture tech, and smart invoicing to streamline financial tasks, allowing our customers to focus on their business priorities.

Once you submit your application, several processes regarding your application will be initiated.

Please note that we are required to pay our service providers an advance fee of €15 for each application that has been started. Therefore, you are responsible for covering this fee.

If you decide to cancel your application after beginning the process, you can do so by sending us an email requesting the cancellation.

Please be aware that the €15 fee is non-refundable.

When you begin your account application, you will have to pay €15 to cover the costs of KYC (Know Your Customer), AML (Anti-Money Laundering), PEP (Politically Exposed Person), and ATL (Anti-Terrorism Law) checks. This fee must be paid immediately in order for us to process your application. Please note that this is a one-time fee.

Once you submit your application, several processes regarding your application will be initiated.

Please note that we are required to pay our service providers an advance fee of €15 for each application that has been started. Therefore, you are responsible for covering this fee.

If you decide to cancel your application after beginning the process, you can do so by sending us an email requesting the cancellation.

Please be aware that the €15 fee is non-refundable.

There is no limit on the amount that can be kept in the account.

There is no limit on the amount that can be received in the account. However, all account transfers and card transactions will be subject to routine compliance checks. In certain situations, access to the account may be restricted during investigations.

To make international payments outside SEPA countries, you will need to use a payment method called SWIFT. We can assist you in executing this type of payment using Sikirapay’s infrastructure. Please visit www.sikirapay.eu

Financial products

SWIFT

You can send any amount you want—there are no limits.

To open an account with SikiraPay, an individual needs to:

– live within the European Economic Area (EU & EEA)

– be at least 18 years old

Non-EU citizens living in France (or any other country within EU or EEA) can apply for an account as long as they can prove their residence in France. ( or any other EU or EEA country).

The requirement is based on residency in the EU or EEA, not on citizenship or passport nationality.

The person would need to provide:

– A valid identity document (like a national passport,in this case, their Serbian passport)

– A proof of address issued within the last 3 months that shows their French address.

This can be:

– A utility bill (landline phone, fixed internet, electricity, water, gas)

– A bank statement

– A document issued by a governmental authority

Additionally, the applicant must use a phone number that is registered with an operator within the European Economic Area.

If your account is deactivated and you want to start using it again, please email us to support@sikirapay.eu, and we will activate your account.

How to Add Money to Your Account

To quickly add funds using your bank card, just follow these simple steps:

- Log in to your account.

- Click “Add funds.”

- Select or enter the amount you wish to add.

- Click “Add funds” again to confirm the amount.

- Enter your card details.

- For future convenience, you can click “Save payment method.”

- Click “Proceed” to finalize the transaction.

You’ll then receive a notification confirming that your funds have been successfully added!

You are not 100% satisfied?

Contact our support team via phone, email or live chat.